As we step into 2024, most of us will be reflecting on our financial habits and how we can make our money punch harder.

Everyone in the world wants to save more and spend less, albeit live life in the best way possible.

Be it a teenager who has just landed their first-ever job, a parent who is running a house, or for that matter, anything in between, saving is a goal that drives its way to the very core of our hearts.

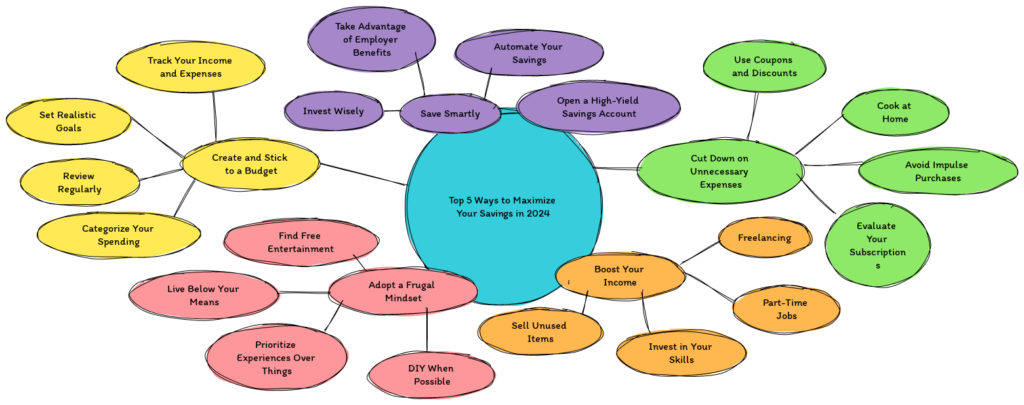

Here are the top 5 ways to maximize your savings in the year 2024 through layman terms, equipped with examples that you can relate to.

Set and Stick to a Budget Budgeting

for sure, can be a yawn and is such a time consumer; however, it is the most potent thing that can save you without feeling deprived.

Set and Stick to a Budget:

Think about your budget as construction for your road map, guiding you to get to your financial destination. Here’s how you can make a budget that works:

Keep track of revenues and expenditures:

Start by noting down every source of earning and all expenses, no matter how trivial they may seem.

You might surprise yourself with the ones through which you are wasting your hard-earned money. Get a notebook, a spreadsheet, a budgeting app, or whatever you think would work best for you.

Categorize your spending:

Categorize this towards groceries, rent, entertainment, and savings. This way, you will be able to identify where you spent too much and where you should cut down.

Reach with Sustainability:

Have specific savings goals, like putting money aside for a vacation, an emergency fund, or a new gadget. It’s amazing what a difference a goal like that can make in turning saving from being a drag into something exciting.

Review Regular:

Lifestyle changes, and so should your budget. Be sure to revisit your budget at LEAST once a month to keep your eye on your prize — making adjustments where necessary. This way, you can keep on course and ensure your budget is current with new financial situations.

2. Cut Out Unnecessary Expenses:

It is easy to spend even on things that one does not need, most of the time without realizing it. To curtail the avoidable expenses does not necessarily mean that one now has to lead the life of a miser instead that is a wiser choice where one considers what is of primary importance.

Evaluate Your Subscriptions

Do you really need all three of these streaming services, the subscription to that magazine, and that box of snacks every month? Cancel the least used and keep only the ones you love.

Prepare at Home:

Yes, eating out may be convenient, but then it’s also definitely tough on the pocket. Cooking at home should definitely mean healthier, cheaper food. Plan your meals, make a list, and stick to it. Besides all that, home-cooked meals are perfect for spending time with your loved ones.

Avoid Impulse Purchases:

Impulse buying can ruin your savings. Before making a purchase, ask yourself whether you really need it. A day or two will not hurt you; maybe you find out that you don’t want it so much.

Use Coupons and Discounts:

Get all available coupons, discounts, or sales offers. The majority of the applications and websites provide coupons at an extremely low price, for foodstuff or clothing. This helps you save a lot with very little effort.

3. Boost You Income

Boost Your Income While saving is pertinent, the clear fact remains that increasing your income would significantly boost your savings. Let us show you some options.

Freelancing:

You could freelance if you are good at writing, graphic design, or programming. You can always check Upwork and Fiverr to look for clients who need such services.

Human Resources:

Season: Since the part-time jobs now look so out of reach, why don’t you just give some gig work a shot? This can range from tutoring and babysitting to even driving for a rideshare company. It’s a good way to make some extra money on the side.

Sell Things You Don’t Use:

Just look around in your house; you will definitely find a lot of stuff that you don’t use or need. You can sell everything online, from eBay to Craigslist and Facebook Marketplace. That way, you kill two birds with one stone: you make money and de-clutter your house.

Investing in your skills:

Sometimes it fetches good job prospects and, as a result, a pay package. Invest in low-cost up-skilling courses online.

4. Save Smartly

Save Smartly It is not only about the quantum but, most importantly, the manner in which you save. Making your savings work for you is going to help you reach your financial goals faster.

Open a Savings Account With High Interest:

For high yield savings account, it is definitely worth it for the yield. Being great over a regular savings account, your money grows much faster. So, research and find that bank that has the best rates.

Save Automatically:

Set up an automatic transfer from your checking account to your savings account each pay period. This way, you can save money without even noticing. It’s one of those really simple tricks that can add up really quickly in the long run.

Take advantage of employer benefits:

If there is a retirement plan like a 401(k) at your workplace, make sure you contribute to it, particularly if they match your contribution. That’s essentially free money to help you sock away for the future.

Invest smartly:

Think of investing in stocks, bonds, or mutual funds where you are going to be exposed to some risk, but on the same vein, risks—if well managed—orchestrated through investments create a higher return. For those new to investing, consider the use of a financial adviser to start you off.

5. Adopt a Frugal Mindset

Cultivate the mindset of frug Being frugal isn’t being cheap; it’s spending on small pleasures and using money wisely.

Here’s how to look at things with a frugal mindset:

Make Fun Free:

Look for free or low-cost entertainment in your community. Most cities offer free concerts, outdoor movies, and other events. Hiking or picnicking in nature is also a good way to enjoy oneself without spending much.

Do It Yourself Whenever Feas:

Instead of hiring someone else to do it, try doing things like home maintenance or car repairs yourself. There are more than enough tutorials online that can show you the way. You’ll save money and learn new skills.

Experiences Don’t Exist With a Click:

Research undoubtedly shows that if you want to be a happier person, you should spend money not on material objects, but on experiences. You won’t spend the money you have on the newest gadget; rather, plan an interesting trip with friends and a weekend of activities and relaxation.

Live below your means:

Living below your means can also be equated to financial freedom. It means making choices in such a way that you are below your expenses. Well, it does not mean that one will not be able to enjoy life; it’s just that it makes one wise in the way he spends.

Conclusion

Smarter saving in 2024 without the headache.

To make a budget and stay with it, cut out all unnecessary expenditure, increase your revenue, save intelligently, and be frugal to the point of insanity in order to register one big on the saving meter and come closer to achieving financial goals. Little switches today can mean big rewards in the future.

Here’s to a prosperous and financially secure 2024!